Introduction

Silvergate bank announced it would begin winding down operations and undergo voluntary liquidation.

On March 8, the bank said it was exploring how it could resolve claims and ensure the continued residual value of its asset while repaying all deposits to clients. The decision was made in light of “recent industry and regulatory developments,” its holdings company Silvergate Capital said.

The announcement came days after the bank announced it would halt the Silvergate Exchange Network (SEN), its real-time settlement service. On March 3, Silvergate submitted an SEC filing stating that it faced inquiries from the U.S. Department of Justice (DOJ) and would file a late 10-K report.

While the bank’s troubles culminated on March 8 with the liquidation announcement, it has struggled for several months. Since the collapse of FTX in November 2022, the bank has seen its stock price depreciate by over 94%.

The most significant 24-hour loss was recorded between March 1 and March 2, when the NASDAQ-listed SI dropped 57%.

The news sent shockwaves through the crypto market, as the U.S. bank served as the backbone for the crypto market, providing financial services to most large crypto companies and exchanges in the country.

Bitcoin dropped to its January low of $19,680 after trading flat at around $21,000 for over a month. The total crypto market cap dipped below $1 trillion, struggling to retain $880 billion at press time.

The crypto fear and greed index has gradually decreased and shows fear. Declining trading volumes and growing exchange withdrawals show investor sentiment is worsening daily.

Despite still being operational, Silvergate has had a profound effect on the market. It triggered a domino effect that will affect not only cryptocurrency companies in the U.S. but the entire banking sector in the country.

In this report, CryptoSlate dives deep into Silvergate to see what brought the former banking giant to its knees and how other banks could share its destiny.

How Silvergate got big

Silvergate was founded in 1988 and began an initiative to service cryptocurrency clients in 2013 after its CEO Alan Lane personally invested in Bitcoin. Further research into cryptocurrencies showed that the market was missing banking services, a hole Silvergate was the first and the quickest to fill.

Silvergate’s decision to stop its mortgage operations in 2005 helped it weather the storm caused by the subprime mortgage meltdown. When the Great Financial Crisis hit in 2008, the bank was among the few in the country who could lend. However, the bank lacked customer deposits to fund these loans and was looking for ways to attract new customers.

The crypto industry in the U.S. was filled with companies with nowhere to go. With Silvergate positioning itself as the sole savior of what can only be described as a banking crisis in crypto, it saw its deposits double in a year. In 2018, it serviced over 250 international clients in the crypto space. As of September 2022, Silvergate had 1,677 customers using SEN.

This was primarily due to Silvergate’s innovative approach to servicing the industry. Instead of just providing custody services to crypto clients, the bank created the Silvergate Exchange Network (SEN), a real-time settlement service that enabled the seamless flow of dollars and euros between crypto companies. The service was revolutionary at the time, as no other bank had real-time payment capabilities that would match the 24/7 payment needs of the crypto industry.

The bank’s services quickly grew to accommodate the rising appetite of the industry — it saw hundreds of millions of dollars in additional investments and began providing Bitcoin-collateralized loans to clients.

As Silvergate charged no fees to use SEN and its customer deposits didn’t bear any interest rates, it profited by using the deposits to invest in bonds or issue loans to earn money on the spread. A Forbes report from October 2022 showed that commitments to SEN Leverage reached $1.5 billion, up from $1.4 billion recorded in June.

This modest growth reflected the relatively flat deposits the bank saw throughout 2022. After its parabolic rise in 2020 and 2021 during the bull market, deposits peaked in the first quarter of 2022 as the network became fully saturated.

Silvergate’s quick and painful death

Then, FTX collapsed and began wreaking havoc on the market. Bitcoin dipped to a two-year low of $15,500, dragging the rest of the market deep into the red. Over $4 billion worth of customer funds on FTX threatened to be lost forever, prompting regulators worldwide to keep a watchful eye on the industry.

And while Silvergate had no lending relationship with FTX, it failed to remain immune from the fallout.

It began seeing an alarming increase in withdrawals as the fourth quarter began. CryptoSlate’s analysis at the time noted that the market was becoming worried that the contagion from FTX could spread to Silvergate’s other creditors. The bank’s ten biggest depositors, which included Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle, accounted for half of its deposits at the end of the third quarter.

Silvergate began borrowing against the long-dated assets it held to combat its dwindling deposits, mostly U.S. treasuries and agency bonds. However, it failed to keep the market at bay and prevent further withdrawals, forcing it to begin selling the assets to pay out its depositors.

With rising interest rates and dangerously high inflation, Silverage reportedly lost at least $700 million on selling $5.2 million worth of bonds in the fourth quarter and took another $300 million on a fair-value adjustment of its remaining portfolio.

At the beginning of November 2022, Silvergate had $11.9 billion in customer deposits. By the end of December 2022, its deposits dropped to $3.8 billion.

The domino effect

While it might take several months for Silvergate to wind down its operations, its effect on the market is already evident. Market sentiment seems to have sloped to a new low, with both retail and institutional investors losing the little confidence they had in banking institutions.

Stock prices for some of the other leading cryptocurrency banks are beginning to show this.

Signature Bank, another large U.S. bank focused on providing services to crypto companies, saw its stock drop over 34% since the beginning of February. SBNY posted a 12% loss between March 7 and March 8. This is a significant loss for the bank, whose crypto deposits comprise only 15% of its total deposits. The bank also doesn’t engage in crypto-backed lending or hold cryptocurrencies on its clients’ behalf. It also signed on several large clients that left Silvergate, including LedgerX and Coinbase.

Despite Barron’s assessment that Signature is still a good buy, expecting its stock to regain its ATH in a relatively short time frame, confidence in the sector is at its all-time low.

After a tumultuous week, Silicon Valley Bank was closed on Friday, March 10.

The New York-based bank saw its stock drop over 62% since the beginning of March after losing 12% in February. Shares of SVB Financial, the bank’s holding company, followed Signature’s pattern — they peaked in October 2021 at the height of the bull market, posting a 176% YoY growth.

The almost vertical drop in the bank’s stock price followed the announcement that the bank needed to raise $2.25 billion in stock. Broader market turmoil pushed many of SVB’s startup and tech clients to withdraw their deposits, pushing the bank to sell “substantially all” of its available-for-sale securities at a $1.8 billion loss.

The bank faced a perfect storm. Clients were pulling their deposits at an alarming rate as they feared the domino effect caused by Silvergate. Its clients, made up mostly of high-growth startups, are seeing a notable decrease in VC funding activity and an increase in cash burn as the market begins to slow down. Morgan Stanley noted that this was the main driver for the decline in SVB’s client funds and on-balance-sheet deposits, even though they said the bank had “more than enough liquidity” to fund these outflows.

However, sources close to the bank revealed on Friday that the bank was reportedly in talks to sell itself as its attempts to raise capital have failed. CNBC reported that “large financial institutions” were looking at the potential purchase of SVB.

Then, the California Department of Financial Protection and Innovation closed SVB on March 10, appointing the FDIC as a receiver. A new bank was created — the National Bank of Santa Clara — to hold the insured deposits on behalf of SVB’s clients. FDIC noted that the bank would be operational as of Monday, with all SVB’s insured depositors having full access to their insured deposits. This means that clients with deposits exceeding $250,000 will receive a receivership certificate that would enable them to redeem their uninsured funds in the future.

Other financial stocks continue to stumble. Spooked by SVB’s securities sell-off and its subsequent shutdown, investors began dumping shares of other large banks in the U.S. The four biggest banks in the U.S. — JPMorgan, Bank of America, Wells Fargo, and Citigroup, lost $54 billion in market value on Thursday, March 9.

JPMorgan suffered the most significant loss, seeing its market cap drop by around $22 billion. Bank of America followed with a $16 billion loss, while Wells Fargo’s market cap was down $10 billion. Citigroup posted a $4 billion loss.

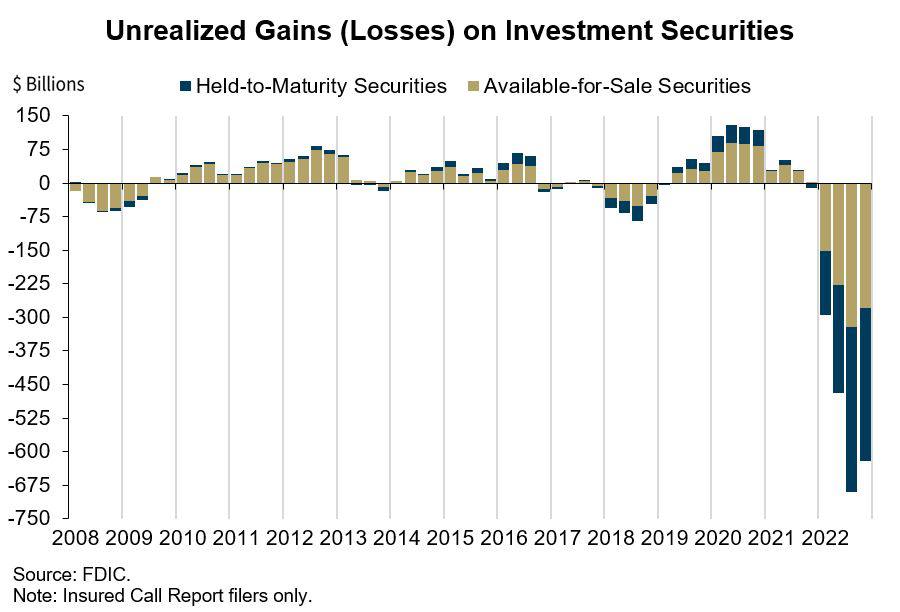

None of the large legacy banks in the U.S. have so far been faced with deposit withdrawals like the ones Silvergate and SVB experienced. Nonetheless, investors seem frightened that the banks won’t be able to meet the outflow demand, as most hold large amounts of long-term maturity assets. Acquired when interest rates were historically low, these securities are worth significantly less than their face values. The Federal Deposit Insurance Corporation (FDIC) estimated that U.S. banks held around $620 billion in unrealized losses on these securities at the end of 2022.

The contagion from Silvergate has spread to Europe as well.

Credit Suisse, one of the largest banks in Europe, saw its shares drop to their all-time low on Friday, March 10, leading other European banking stocks down with it.

And while the loss Europe’s STOXX banking index saw was just 4.2%, it still represents the biggest one-day slide since June 2022. Other major banks in the E.U. also saw significant losses, with HSBC posting a 4.5% loss and Deutsche Bank dropping 7.8%.

Regulatory blowback

The collapse of FTX triggered an unprecedented regulatory crackdown on the crypto industry. This has been most apparent in the U.S., where lawmakers have been fighting a vicious fight over how to regulate the booming market.

The collapse of FTX only added fuel to the fire, creating an aggressive new movement that set its sights on tightening its reigns on the industry.

Earlier this week, Sen. Elizabeth Warren said that Silvergate’s failure was disappointing but predictable:

“I warned of Silvergate’s risky, if not illegal, activity — and identified severe due diligence failures. Now customers must be made whole, and regulators should step up against crypto risk.”

Warren’s criticism wasn’t met with approval, though. Aside from the generally negative market reaction, four Republican senators sent a letter to the Board of Governors of the Federal Reserve condemning the increased regulatory pressure.

In the letter, they stated that the organized attempt to de-bank the crypto industry was “disturbingly reminiscent” of Operation Choke Point. They called for the Federal Reserve, FDIC, and OCC not to punish the entire crypto industry as the overreaching behavior of banking regulators will inevitably bleed into other industries.

On March 10, U.S. Treasury Secretary Janet Yellen met with officials from the Federal Reserve, FDIC, and OCC to discuss the situation regarding SVB. Later that day, while testifying before a House Ways and Means Committee hearing, she said that U.S. regulators were monitoring several banks affected by recent developments.

Conclusion

It took over four months of market turmoil to bring Silvergate to its knees. However, the domino effect it triggered led to exponentially faster deaths for other institutions in line behind it.

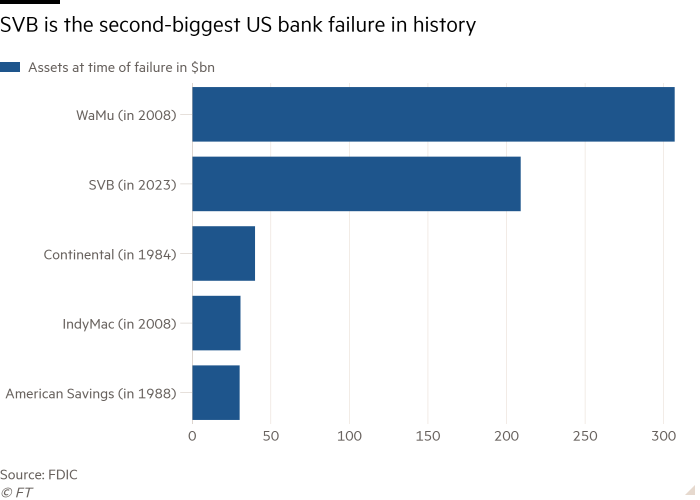

Silicon Valley Bank closed down after less than a week of speculation about its solvency. It took hours to become a poster child for the crypto banking crisis — SVB is now the second-biggest bank failure in the U.S. ever recorded.

However, the domino effect that began with Silvergate hasn’t ended with Silicon Valley Bank. The full scope of the blowback is yet to be felt as both banks will take months to wind down their operations.

In the meantime, bank runs are set to threaten even more financial institutions servicing the crypto and tech industries. We can expect other small to mid-size banks to struggle with paying out customer deposits.

The crypto banking sector’s unfortunate but most likely future will be aggressive centralization and corporatization. As more and more boutique banks shut down, large crypto companies and exchanges will flock to large legacy banks. Small crypto companies will continue to struggle securing banking services, leading to mass relocations or cheaper acquisitions by larger competitors.