Crypto’s US Dollar market depth has significantly dropped over the past month following Silvergate’s struggles, according to Kaiko data.

US exchanges are becoming less liquid.

Kaiko said U.S.-based exchanges and market makers are becoming less liquid as they seem most affected by Silvergate’s implosion.

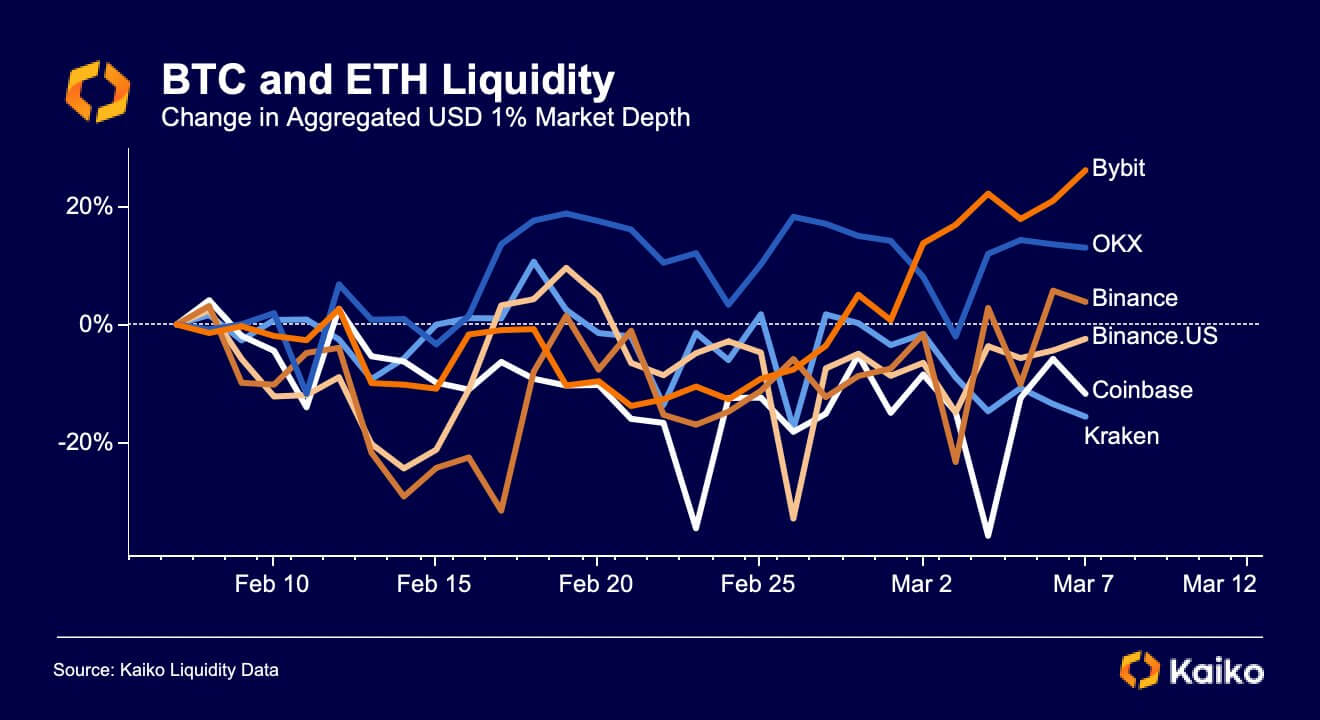

According to Kaiko data, Bitcoin and Ethereum’s market depth improved across international exchanges like Binance, OKX, and ByBit in the last 30 days. However, they worsened on US-based exchanges like Coinbase and Kraken during the same period.

The crypto market’s liquidity measures how the market can absorb large buy and sell orders without significantly affecting prices.

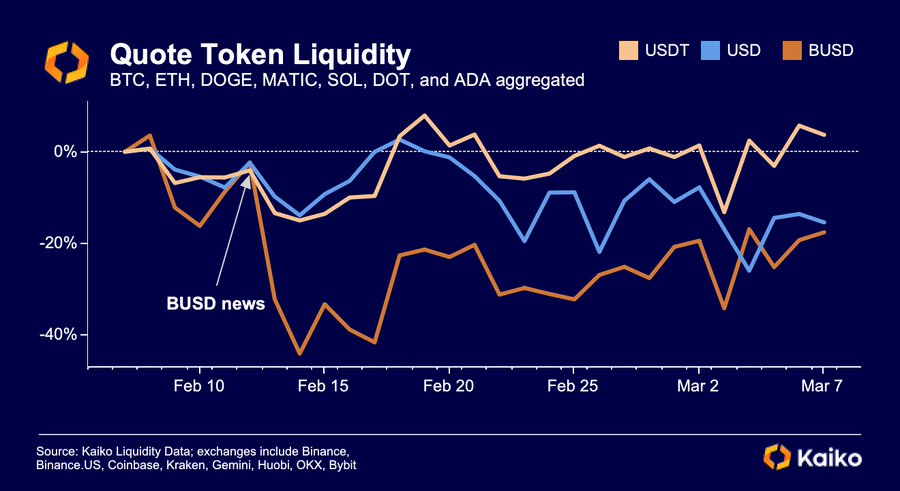

The on-chain data aggregator noted that the USD’s liquidity level was close to that of Binance USD (BUSD) stablecoin. However, BUSD’s liquidity for its top pairs had dropped by as much as 40% when New York’s financial regulator ordered the asset’s issuer Paxos to stop further mints.

While BUSD’s liquidity level has begun to improve slightly, Kaiko said the Silvergate news was “weighing on USD pairs,” bringing it closer to the level of the embattled stablecoin.

Meanwhile, the liquidity drop across US exchanges appears to have contributed to ETH and BTC’s slight negative market depth over the period.

Silvergate role in crypto’s USD liquidity

The significant USD liquidity decline shows Silvergate’s role in connecting the traditional financial system and the crypto industry.

At its peak, the bank’s Silvergate Exchange Network (SEN) reportedly processed over $219 billion in transfers and generated $9.3 million in revenue during the fourth quarter of the 2021 market rally.

Major crypto firms, including Coinbase, Gemini, Paxos, and Circle, used the services. Unfortunately, these institutions were forced to drop the bank due to concerns about its ability to continue operating.

Altcoins affected

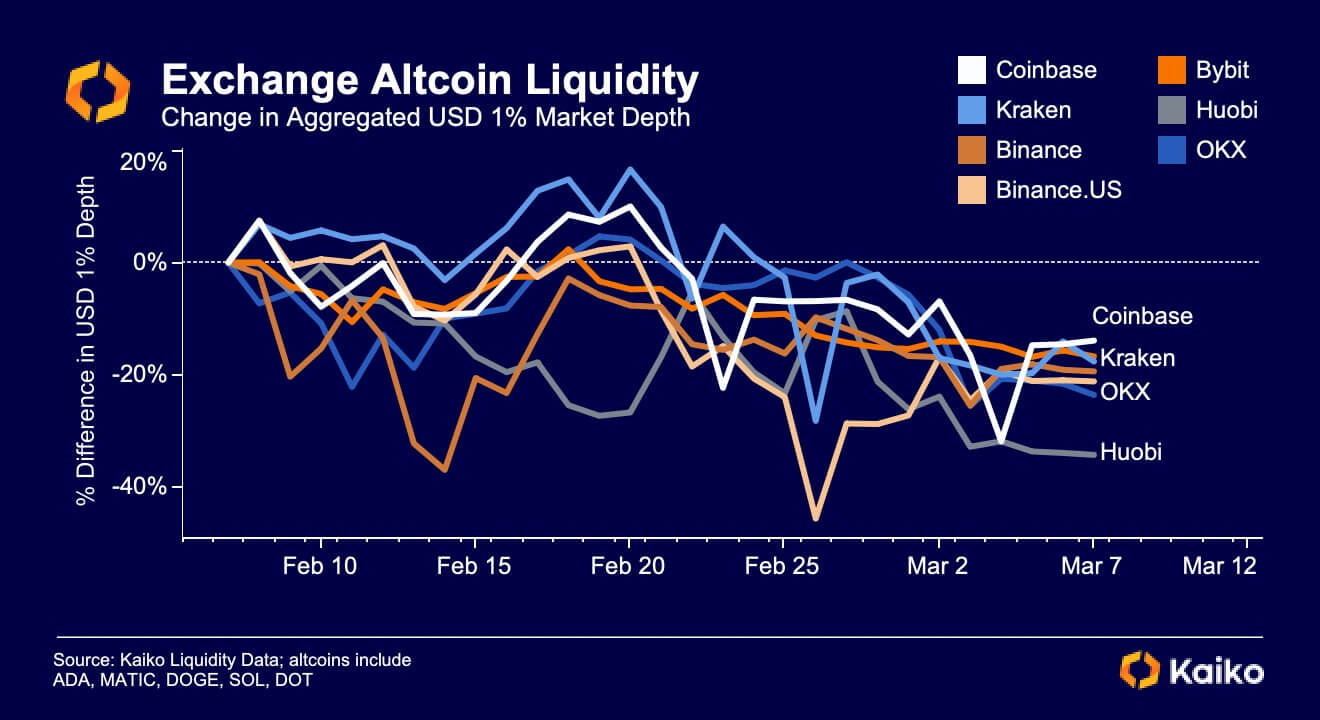

Meanwhile, the worsening liquidity appears to affect altcoins across several exchanges.

Kaiko’s data showed that several exchanges had lost more than 15% of their market depth for altcoins, like Cardano’s ADA, Polygon’s MATIC, Dogecoin’s DOGE, Solana’s SOL, and Polkadot’s DOT during the last 30 days.

According to the data, the least affected exchange was Coinbase, whose depth for these crypto-assets dropped 14%, while others like Bybit and Kraken lost 17% each. Binance and its US subsidiary shed 20%, respectively, while Huobi is down 35%.

Euro’s volume rises against USD.

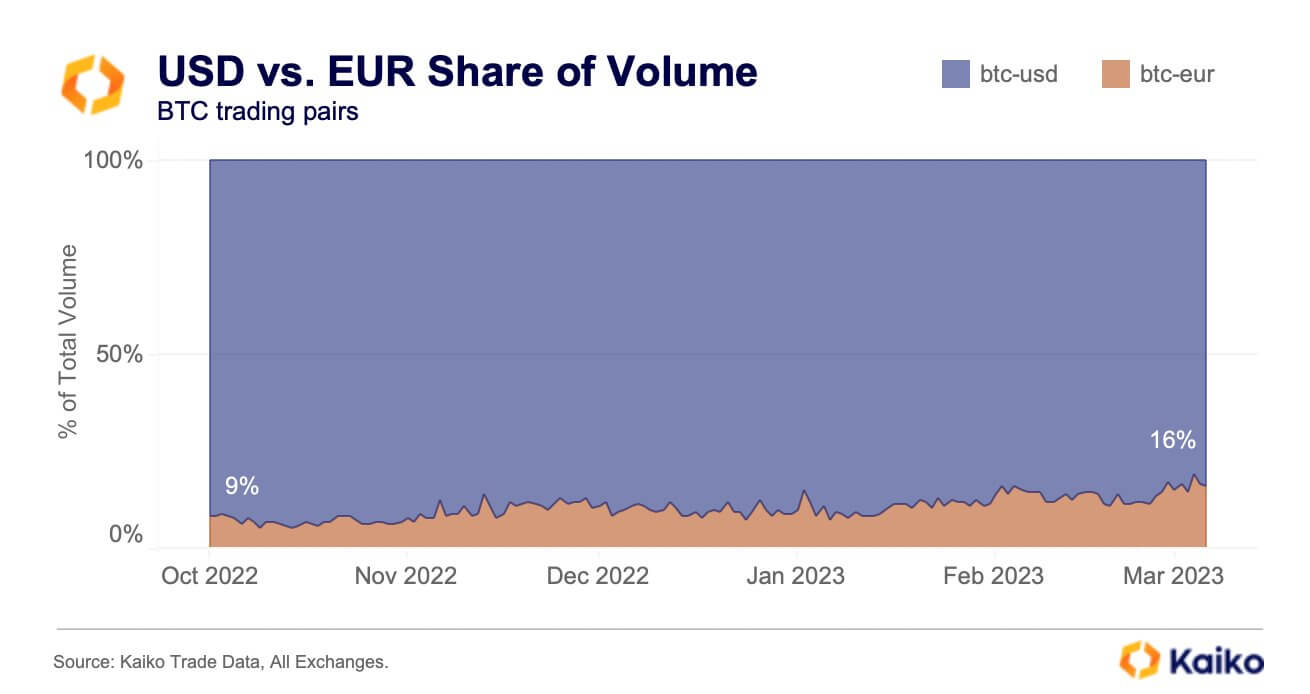

While USD’s liquidity has been dropping against the crypto market, the European Union’s Euro has been gaining ground against Bitcoin, according to Kaiko data.

Kaiko pointed out that the Euro’s volume relative to USD has nearly doubled since FTX’s collapse in November 2022. According to the firm, Euro’s volume rose to 16% from 9% for BTC markets.

The increased Euro volume has coincided with the rise of Euro-backed stablecoins. As a result, the top two stablecoin issuers, Tether and Circle, have introduced stablecoins backed by the Euro to gain market share.