The emergence of the Ordinals protocol has transformed Bitcoin from a somewhat stale single-asset chain into something much more exciting.

However, this newfound excitement has sparked pushback from laser-eyed purists, who argue that BTC was not intended for non-monetary transactions – some going as far as calling the protocol a spam attack on the network.

Brushing aside the protests, Ordinals Capitalists say a permissionless system also includes the liberty to utilize Bitcoin in any manner one chooses. They accuse purists of attempting to spoil their fun.

The divergent viewpoints have set the stage for a potential chain split – which ultimately serves no one’s best interest.

Taproot opened Pandora’s box

The Taproot soft fork was rolled out in November 2021. At the time, it was primarily regarded as an upgrade to improve network security, efficiency, and scalability. However, it also enabled executable commands and the implementation of certain scripts – thus laying the foundation for Ethereum-like functionality such as smart contracts and dApps.

In January, the impact of this additional Ethereum-like functionality began to take shape as developer Casey Rodarmor released Ordinals. This protocol allows for each of the 100,000,000 satoshis in a Bitcoin to be inscribed with additional metadata, including text, images, video, and code.

By February, the Ordinals protocol was used to write a wizard jpeg into the blockchain, opening the door to a Bitcoin NFT market. But as a “square peg, round hole” use of the technology, acquiring and trading Bitcoin NFTs was a cumbersome and technically challenging feat, requiring knowledge of node synching and trusting a third party to release the NFT upon payment.

Recently, supporting wallets, including Ordinals Wallet, Xverse, and Hiro Wallet, have rolled out to address these pain points, making the process more like the standard experience NFT buyers are used to.

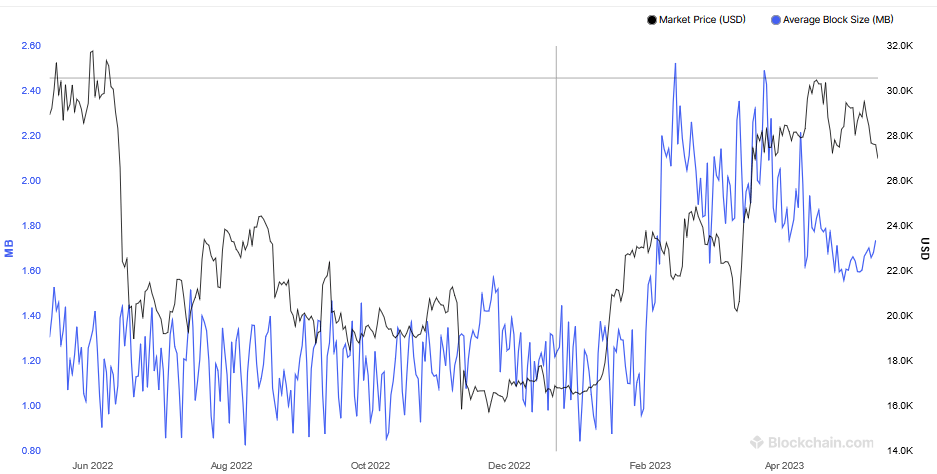

Before Ordinals NFTs went live, the average block size was hovering around 1.2 MB, but since its rollout, subsequent blocks have more than doubled on average – negatively affecting speed and scalability. Additionally, higher transaction fees and chain bloat, through a backlog of unconfirmed transactions, have added to useability problems.

Here come the BRC-20 tokens

Things stepped up in March when anonymous developer “Domo” launched BRC-20 tokens – bringing a fungible token standard to Bitcoin. By attaching a JavaScript Object Notation (JSON) to satoshis, details of the BRC-20 token’s characteristics, including its minting and distribution values, are preserved in the network.

Spurred by meme coin season, BRC-20 tokens saw a peak market cap valuation of $1 billion on May 8. However, wider market uncertainty and the prevalence of meme coin rugs have since seen a significant drawdown – falling to $574 million at the time of press.

Per KuCoin, the booming popularity of BRC-20 has worsened the problems seen with NFTs, causing significant network delays, with some users reporting 4-hour confirmation times. In addition, BRC-20 tokens have further contributed to rising transaction fees.

Despite useability issues, miners are reaping the benefits with on-chain metrics, including Miner Hash Price, which measures miners’ income relative to network contribution, and Miner Percent Mined Supply Spent, which looks at the rate miners sell mined coins, pointing to a reinvigoration of the Bitcoin mining space.

CryptoSlate’s analysis concluded that if the momentum continues at its current pace, miners will experience boosted profitability and a greater sense of confidence in the network, leading to a preference to hold onto mined coins.

Community split on Ordinals

Prominent members of the Bitcoin community have voiced their support of Ordinals. For example, MicroStrategy Chair Michael Saylor said the protocol was responsible for flipping sentiment bullish – adding that if he was a miner, he would be ecstatic.

Moreover, he pointed out that the technology will lead to many new applications in the long term, some of which could solve critical societal issues – giving the example of inscribing a will on the blockchain.

“I could also inscribe my last will and testament, and if my last will and testament is moving a billion dollars from me to you, how much is it worth to you to have that burned onto the blockchain and cryptographically verified?”

Meanwhile, Willy Woo expressed a more pragmatic view, saying there are good and bad points to consider. While additional transaction fees provide strong incentives for miners, which will become more critical in the future as block rewards dwindle with each halving, this comes at the cost of more centralization due to fewer people being willing to run higher bandwidth nodes.

For now, given that decentralization is not “anchored” in, Woo said Ordinals, and the associated boon for miners, arrived too soon for his liking.

“I would have preferred the impact of ordinals to have been a lot later when the security budget becomes more pressing, it would be at a time when decentralisation is already anchored.“

Jan3 co-founder Samson Mow played down the significance of Ordinals. He said congestion and high fees are nothing to worry about, as paying massive fees to miners is unsustainable over the long term.

“It’s a question mark on how long they can do that for. Maybe it’s a few more days. Maybe it’s a week. But definately it’s not a sustainable model to throw money away.”

Clarifying his position, Mow explained that Ordinals is a largely hype-driven market fueled by short-term money grabs. What’s more, he predicts the sector will disappear once the token issuers have made enough money.

“They exist to get some gullible people to pay attention to them by doing some crazy antics…

But like most projects that are in the blockchain space, they fade away in relevance once the issuers of the tokens have made their money.”

What would Satoshi think?

Satoshi Nakamoto cannot express an opinion on whether Ordinals are good or bad for Bitcoin. But people have turned to his Bitcointalk forum posts to try and work out his perspective on the matter.

In a December 2010 post, Nakamoto supported the idea of keeping the blockchain lean and free from bloat with a view to maximizing scalability.

“Piling every proof-of-work quorum system in the world into one dataset doesn’t scale.”

Nakamoto spoke of segregating non-monetary transactions onto a separate chain called BitDNS – which was conceived as a sidechain or layer 2 using the Domain Name System internet protocol. Later, this project became an altogether separate alt chain, rebranding to Namecoin.

“Bitcoin and BitDNS can be used separately. Users shouldn’t have to download all of both to use one or the other. BitDNS users may not want to download everything the next several unrelated networks decide to pile in either.”

Based on this, it seems Nakamoto wanted to keep the mainchain exclusively for monetary transactions and for a sidechain/layer 2 to handle large data features.

The Bitcoin core devs also seem to have adopted the purist’s stance, as indicated by @frankdegods, who publicized dev plans to extend Taproot spam filters to remove Ordinals altogether.

Bitcoin civil war

In a throwback to 2017 and the Bitcoin Cash hard fork, the question of whether Bitcoin should increase its block size to accommodate Ordinals has ignited debate within the community.

Given the lack of consensus on the best path forward, the possibility of a further chain split looms increasingly likely. But, of the 105 BTC forks to date, it’s worth noting that all have faded into obscurity.

The most successful fork, Bitcoin Cash, is down 98.9% against Bitcoin from its 0.43 peak in November 2017. This suggests that an Ordinals fork would likely face significant challenges, making a split futile.

There is no shortage of alternative layer 1s offering tokenization with the added benefit of more sophisticated features, such as event logic handling. Moreover, these alternative layer 1s can operate at a larger scale and lower cost than Bitcoin – making Ordinals something of a dinosaur in comparison.

Yes, Ordinals has breathed new life into Bitcoin, particularly from a novelty and mining sustainability point of view. But other chains are better at tokenization.

Moreover, to date, the protocol’s primary use case is meme coin investing, which lacks utility, has no collective benefit, and does not contribute to the goal of doing away with the corrupt fiat money system.

Ordinals are bad for Bitcoin because it impedes the objective of revolutionizing money.